Although fixed assets are a crucial component of any business, not every system enables you to precisely manage their depreciation and life cycle. In reality, a lot of businesses still use spreadsheets to keep track of their assets. Your business can precisely track, manage, and depreciate its fixed assets with the help of NetSuite Fixed Asset Management.

Additionally, the Fixed Assets Management module is connected to NetSuite ERP, enabling your business to build assets from invoices or purchase orders and post devaluation or asset retirements straight to NetSuite general ledger accounts.

This NetSuite fixed asset guide will define NetSuite Fixed Assets Management and describe how it may make tracking fixed assets easier for your business. Let us start with understanding the meaning of asset management and its importance.

What is NetSuite Fixed Assets Management?

NetSuite Fixed Assets Management plays an impactful role in automating your company’s asset and lease management procedures, doing away with manual work and spreadsheets. The solution from NetSuite provides the users with a configurable depreciation and amortization schedule, extensive asset reporting, and seamless interaction with NetSuite’s core accounting features for company-owned and leased assets.

Furthermore, by automating fixed asset depreciation and lease accounting, NetSuite Fixed Assets Management improves the timeliness and accuracy of financial reporting. It enables the user to maintain a thorough inventory of all current assets, keeping track of information like contract value, term, discount rate, and pertinent information like cost of purchase, date of installation, and anticipated useful life. Additionally, with the help of fixed assets management, you can easily manage the whole asset lifespan, from purchase to retirement, without needing labor-intensive spreadsheets.

Why Should We Choose Fixed Assets Management?

Asset creation is simple with NetSuite Fixed Assets Management because you can select and keep track of essential variables and data about a specific asset and the default in asset types when establishing an asset. It enables you to:

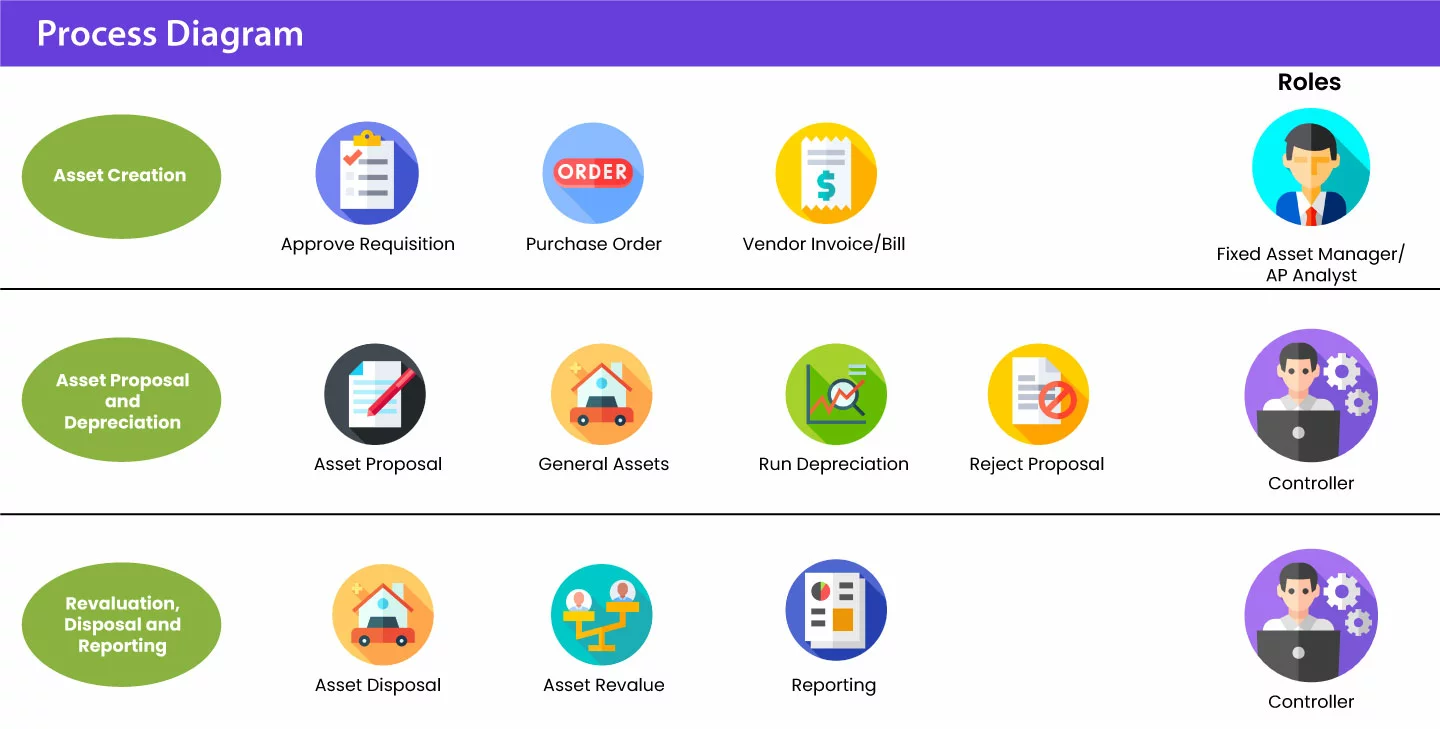

- Maintain control over all asset-related business transactions, including asset creation, proposal, depreciation, revaluation, transfer, disposal, and splitting.

- Track all business assets, including both depreciating and non-depreciating ones.

- Create assets quickly using infinite asset categories, and report on them.

- Produce assets with the appropriate number and values to enable users to produce numerous assets from transactions with multiple quantity records.

- Keep track of pertinent asset information, such as insurance, leasing agreements, and maintenance schedules.

- With the least amount of work possible, use automatic defaults for asset formation, depreciation, and eventual retirement.

- Keep track of and depreciate each component according to its depreciable cost and useful life.

- Transfer assets across locations or between subsidiaries and revalue an asset to reflect its current market worth; you can raise or lower its value.

Different Modules of Fixed Asset Management

1. Asset Creation And Proposal

NetSuite Fixed Assets Management tracks all fixed assets-related transactions. Bills, customer orders, and purchase invoicing can all be converted into fixed assets. However, you must keep the following points in your mind while dealing with this module:

- The sole prerequisite is that the transaction posts to a general ledger account for fixed assets.

- A fixed asset cannot be generated from a transaction if not deposited into a fixed asset account.

- Additionally, you may manually generate assets or import CSV data.

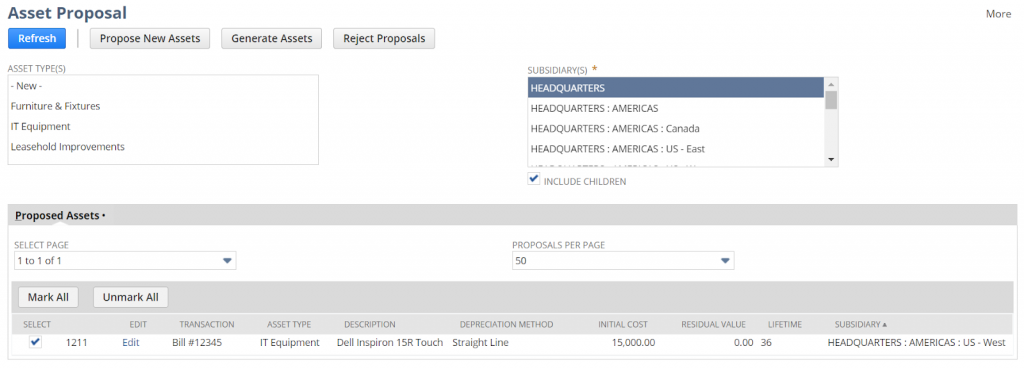

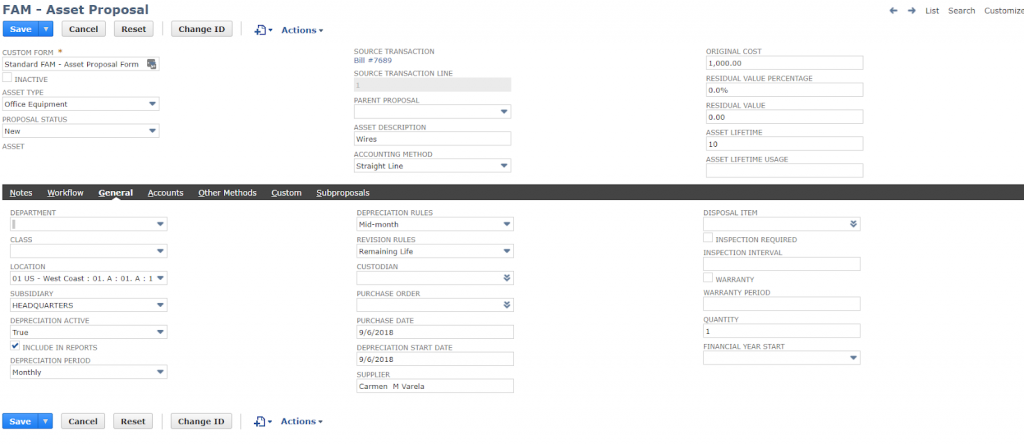

Asset proposal, however, is the initial stage in fixed asset creation. The Asset Proposal page contains information about all transactions posted to a fixed asset account. You can accept or reject the suggestions on this page. If a proposal is approved, a fixed asset is subsequently established using the account’s transaction-related default data for the Asset Type.

Steps for Asset Generation:

Step 1: First, enter a PO, receive, or bill. You can do it anytime throughout the month. For Navigation, first, go to Transactions > Payables > Enter Bills to receive a PO or enter a bill immediately. The PO/Bill should be instantly connected to the asset account with a note field description of the asset.

Step 2: Next, propose an Asset in the NetSuite fixed assets proposal Module. You can do it once every month, preferably during the month-end closing procedure.

Step 3: Under Asset Type(s), choose one or more Asset Types to produce asset proposals from the menu options Fixed Assets > Transactions > Proposal. Choose one or more subsidiaries under Subsidiary (or click include children check box for all subs) and select “Propose New Assets.”

While nothing may appear to be occurring, NetSuite is processing the Asset Proposals.

- You can check it by following the given steps: Fixed Assets > Transactions > Transaction Status.

- You may view a list of the ongoing and finishing processes on the Transaction Status screen.

- You may click the hyperlinks for further information by going from there. You should be ready as long as the “Record Processed” is shown.

Step 4: Finally, you need to accept or produce assets. You can run it once every month, ideally during the month-end closing procedure. For Navigation, click on Transactions > Proposal > Fixed Assets.

Reviewing each item being suggested is a good practice to ensure the information is current. Other aspects of the asset, such as the depreciation method and start date, can also be changed. When finished, press the Save button. Tick the box to the left of the asset to choose it, and then click “Generate Assets” (or “Reject Assets”) towards the top of the Asset Proposal page. NetSuite will be idle, just like when recommending a new asset. The same navigation is used as in Step 1 to view the Transaction Status.

2. Asset Depreciation

The NetSuite fixed assets management software supports a variety of depreciation techniques and keeps track of the expected and actual decline for each asset. The entire process can be broken down as follows:

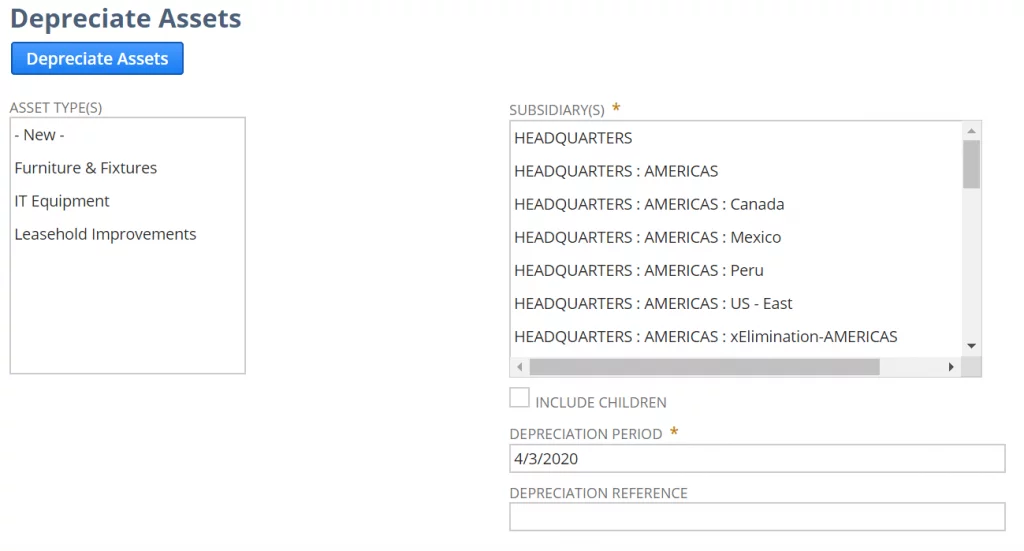

- You may choose the asset type, the affiliate it belongs to, and the timeframe you want the journals to publish on the Asset Depreciation page.

- Once you select the fixed asset category, a journal entry is automatically made to reflect the depreciation to the general ledger when the depreciation for the chosen asset categories has been calculated.

- It summarizes depreciation entries using sub-categories, parent assets, and asset types.

Steps for Asset Depreciation:

Timing: During the month-end closing procedure, once every month.

Step 1: First follow the Navigation: Asset Depreciation > Fixed Assets Transactions

Step 2: To create asset proposals, choose one or more asset types under Asset Type(s).

Step 3: Choose one or more subsidiaries under Subsidiary (or click include children check box for all subs).

Step 4: Enter the month’s end date (12/31/2021) in the Depreciation Period area. You may leave the Depreciation Reference field empty to have NetSuite automatically produce a reference number, or you can put a JE Reference number in it.

Step 5: When ready, press the “Depreciate Assets” option.

In contrast to the others, this method will lead you immediately to the Transaction Status screen, where you can check how many transactions were handled. To view the journal entries that have been uploaded, go to Transactions > Financial > Make Journal Entries > List and choose the most recent entry (i.e., you can sort by latest Internal ID.

By going to Fixed Assets > Lists > Assets and choosing the Asset in issue, you can also confirm the depreciation related to a specific fixed asset by looking at the depreciation record made to the FAM-Asset Record. You can see the amortization entries posted by looking at the Depreciation History tab.

3. Asset Revaluation, Disposals, And Reporting

The Fixed Asset module keeps track of asset sales and revaluations as well. Both of these transactions are started in the Fixed Asset module and result in the creation of the relevant journal entries that show the value change and any associated gain or loss.

- Standard reports in NetSuite Fixed Assets Management let you manage your fixed assets.

- You may choose the report for the period range of the subsidiary and/or regions and departments on the NetSuite fixed assets reports page.

- Even better, you have the option to export the report as a CSV file.

Steps for Asset Revaluation:

Step 1: Follow Navigation: Asset Revaluation > Transactions > Fixed Assets.

Step 2: Choose the asset in the “Asset ID/Name” column.

Step 3: Enter a write-down percentage or amount and/or change the residual value, lifetime, and depreciation method.

Step 4: Add a “Transaction Date” there. Before processing, you can compute the write-down percentage by clicking the calculate button, or you can process by clicking the “Process Revaluation” button.

Step 5: When the revaluation is finished, you will be sent to the Transaction Status Screen. You may confirm the amount by looking at the write-down entry made to the FAM – Asset Record and choosing the relevant Asset under Fixed Assets > Lists > Assets.

You may confirm the amount by looking at the write-down entry made to the FAM- Asset Record and choosing the relevant Asset under Fixed Assets > Lists > Assets. By looking at the Depreciation History tab, you can see the published journal item.

4. Lease Management

NetSuite Fixed Assets Management tracks both financial and operational leases. The lease values are automatically determined based on the monthly lease payments, interest rate, and lease duration.

- Time will be saved during month-end closure using the Record Lease Interest tool to create interest cost journal entries for all leases automatically.

- Leases may be transferred to different companies, regions, or asset classes.

- The statistics for leases may include, but are not restricted to, the connected fixed asset, initial journal entry, payments, terms, interest expenditure, and net present value.

Steps for Lease Management:

Step 1: You can conduct lease management whenever necessary. For navigation, first, select o

Step 2: Choose the asset in the “Asset ID/Name” column.

Step 3: If you are selling the item, you can create an invoice for the customer by entering the appropriate information in the “Sale Items,” “Customer,” and “Sales Amount” boxes.

Step 4: Make that your sales item is linked to a Gain/Loss on Sale of Asset G/L Account, as noted.

Step 5: Fill out the “Disposal Date” and “Disposal Type” fields (i.e., Sale or Write-off).

Note: If an asset record has various quantities, you can write off or sell a piece by entering the different quantities in the “Quantity Disposed” box. When ready, click Dispose.

You will be brought to the Transaction Status screen when the disposal is finished. By going to Fixed Assets > Lists > Assets and choosing the disputed asset, you may check the amount by looking at the sale write-off item that has been added to the FAM – Asset Record. By looking at the Depreciation History tab, you can see the published journal item.

Go to Fixed Assets > Lists > Assets and pick the relevant Asset to examine the Disposal/Invoice that was submitted to the FAM – Asset Record. If you look at the Asset Sale/Disposal page, you may see the invoice that was sent.

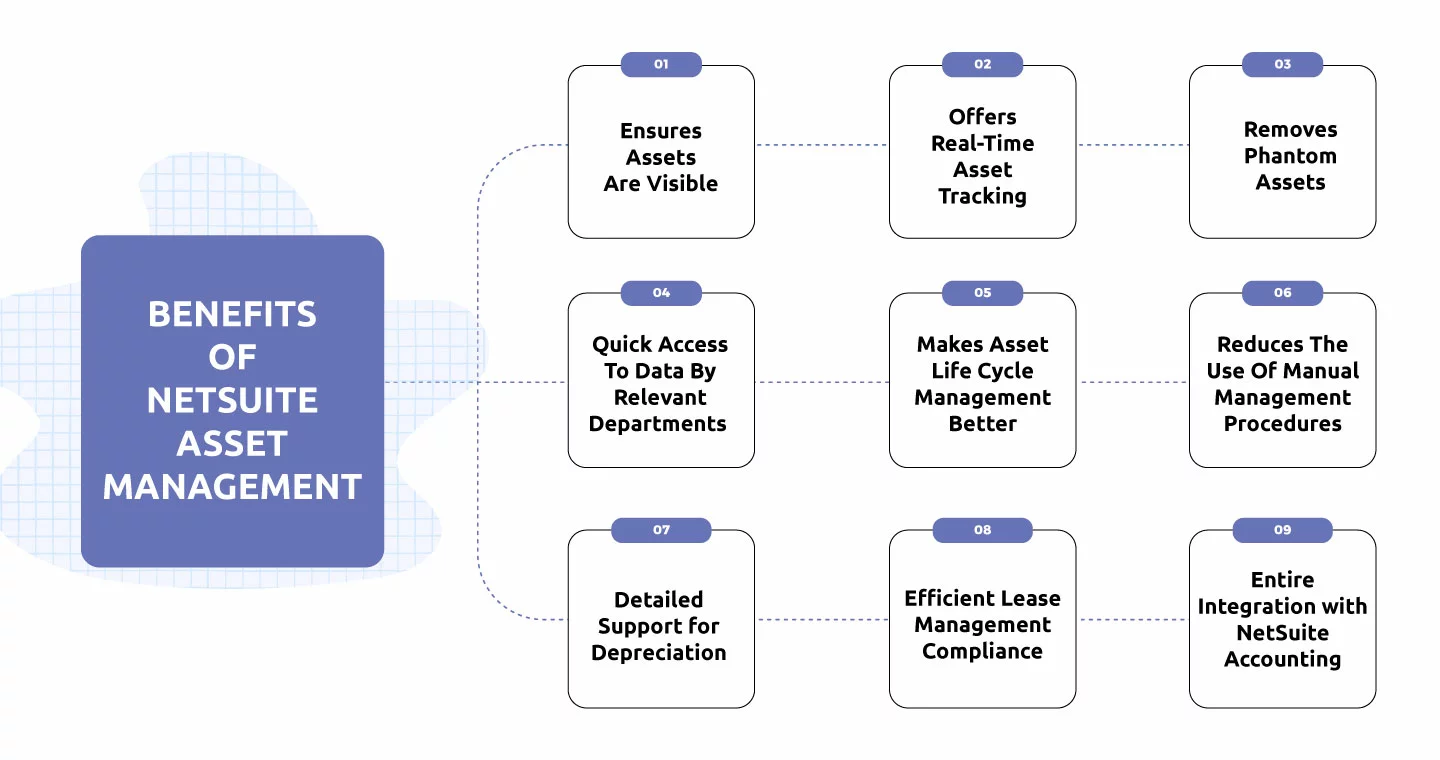

Advantages of Opting For NetSuite Fixed Assets Management

- Adaptable depreciation. Create your own depreciation scenarios using user-defined schedules or utilize the built-in templates.

- Easier Compliance. Automate lease payments, expenditure amortization, and reporting to make observing lease accounting requirements easier.

- Financial economizing. Recognize “ghost assets” and halt payments for machinery no longer used.

- Detailed Reporting. Gain access to in-depth analysis of cost, depreciation, lease expense, and related data for almost any operational domain.

Wrapping-Up!

Any firm faces challenges with asset management. The fixed asset management solution offered by the NetSuite Fixed Assets Management is effective, simple to use, affordable, highly functional, and time-saving. Without diligent asset management, organizations risk seeing their profitability decline as their assets lose value and become ineffective, which would lead to decreased production.

An effective solution that may optimize the way your business monitors, fixed assets is NetSuite Fixed Assets Management. With years of expertise deploying the Fixed Asset module for our clients, the certified NetSuite implementation partners at VNMT are eager to assist you. Contact our NetSuite team right away to get started.