The two main players who are involved in B2B payments are the buyer and the supplier. The B2B payment system has seen a drastic change in the last two years. It gave a pandemic a reason for this shift, and one must also understand that there was indeed a general push towards digitizing the same.

“Every B2B business is on the path to becoming a digital business. New forms of digital customer engagement … are transforming B2B businesses, forcing them to fundamentally rethink how to meet customers where they buy and what the role of sales is when they get there.” — Forrester

The B2B payment solution, if made digital, can be an excellent opportunity for your organization. Especially in terms of growth and ease of operations. Digitizing the payment, a B2B payment solution can

- Improve the Cash flow for the organization

- Massively Reduces Manual Work

- Get excellent insights on tail-end spend

This article gives a complete idea of the trends of B2B payments this year. Further, you will also learn the advantages of making the B2B payment solution a virtual one.

Benefits of Virtual Payment Solutions

Let us quickly understand the advantages of a virtual payment solution in the beginning, to give more concreteness to the trends of 2024.

Streamlining Cash Flow

This is the best advantage of a B2B virtual payment solution. You can automate the entire payment process for your suppliers. Further, the transactions made can be generated as a report on a timely basis too. NetSuite Accounting has a lot of benefits over many digital payment platforms. The real-time visibility of the transaction and real-time report generation make it a fabulous payment solution for organizations. It helps the organization in many ways. You can profit from the extended payment period, and you are paying your suppliers punctually. That means to say, you get

- Free credit line

- Increased Cash Flow for the organization

It is by far the best when compared to the usual bank transfer methods.

Payment Automation

Keeping an automated payment processing solution is of paramount importance in business focus and agility. You can reduce a lot of time wastage in the payment process if the solution is digitized. You need not go on for multiple manual checks and do a lot of paperwork to process the payments. Further, it can productively save time to focus on the core business ideas. Also, while using an automated payment system, all the payments are made centrally. That means to say; there will be little to no error inaccuracy of the payment too.

Supplier Price Negotiation

The digital payment platform is a great launchpad to improve your business standards. As the payments are automated and the patterns of spend are also identified, you will have all the data to negotiate with your supplier. A mutually beneficial price plan can be arrived at. Further, you will also make earlier payments, and in such cases, it can reduce the price to a better margin.

Secured Payment

As compared with the manual payment processing methods, the digitized one is more secure. The zero error processing methods and secure platform make it most sought after by many organizations. You have the liberty to set master access to the finance and accounting portals for your organization.

Improved Client Relationship

Making payments on time improves relationships. Business revolves around cash, and when payments are made with consistency, you build a reliable image for all your clients. It will help you build relationships and keep you on priority in your client’s business plan.

“Automation might allow costs to go down, KPIs to improve, and customer relationships to be enhanced in the process.”

American Express

With these delectable advantages, a virtual payment method like NetSuite Accounting provides huge benefits and is the best support for organizations of any size and niche.

Top B2B Payment Trends for 2024

The online transactions between buyers and suppliers have increased recently. The advent of technology and circumstances led them to transact digitally these days. Manual checking methods are being neglected; the virtual payment system is more sought after. The recent trends in the payment system are sure to continue this year as well.

“The pandemic accelerated a lot of trends that were catching traction the year prior … Evolution from both the merchant and customer side picked up pace to evolve with changing market conditions.”

Lily Varon (Analyst, Forrester)

Real-Time Payments (RTP)

The businesses are looking for quick and reliable payments from their customers, i.e., the buyers. As a B2B solution, RTP ensures immediate payments. Moreover, as the payment is made, both parties are sent a notification as well. It translates not only to transparency but also a confirmation of the payment that is done on time.

As you make real-time payments, it is very well accepted by the companies, and the benefit of them serving you next time is never denied. The main reason is you pay them not only promptly but also quickly. If you notice, the below-mentioned businesses opt majorly for real-time payments.

- Bill Pay

- E-Invoicing

- Insurance Services

- Claim Settlement

“In the U.S., we really didn’t have a need for real-time payments for a long time … But that is starting to change, as people are expecting more and financial institutions see an advantage to make payments faster.”

Sarah Grotta

Director of Debit and Alternative Products Advisory Service, Mercator Advisory Group

As you make the payment in real time, it is updated, and the respective data is secured for future purposes. Say, for example, you pay the insurance. It gets instantly updated, unlike the manual methods.

Cloud Payment Solutions

It is of greater significance in the business world. Unlike local server usage and limited technology resources, Cloud-based solutions offer you immediate payments with more security and convenience.

As such, late payments from your end will cause an unnecessary rift between the businesses. It can be hugely avoided with NetSuite Accounting Implementation. The Cloud-based solution makes use of remote servers. So, the payment processing is done anywhere and anytime. You can leverage the following benefits if a Cloud-based payment solution is used.

- Faster Cash Flow

- High Flexibility

- Incredible Security

- Automation

The biggest challenge of late payments is avoided. Also, the client and customer relationships are maintained as well.

Read More: Traditional Accounting VS Cloud Accounting: Key Differences & Advantages

Fintech Companies are Booming

With traditional banking services being a bit slow in transactions, the Fintech organizations focus on faster transaction rates. Many companies have emerged in the finance industry, and each one has its competitive edge over the other. At the same time, the features offered by Fintech overpower the other. The constant innovation process in this regard is inevitable. Fintech organizations have not only emerged in recent times, but their customer offerings also vary and are incredible too.

“Another big trend I can see is “embedded fintech”, which is that many non-fintech companies, like Uber, Instagram, and Shopify enter the fintech market by adding banking or payment capabilities in their product,”

Nikos Melachrinos (CEO at Quirk)

On the other hand, the banks also establish connections with the Fintech companies to reduce costs and raise their standards. The banks have comparatively older technology that Fintech is taking leverage on. The innovations that the companies come up with will grow faster in the future too.

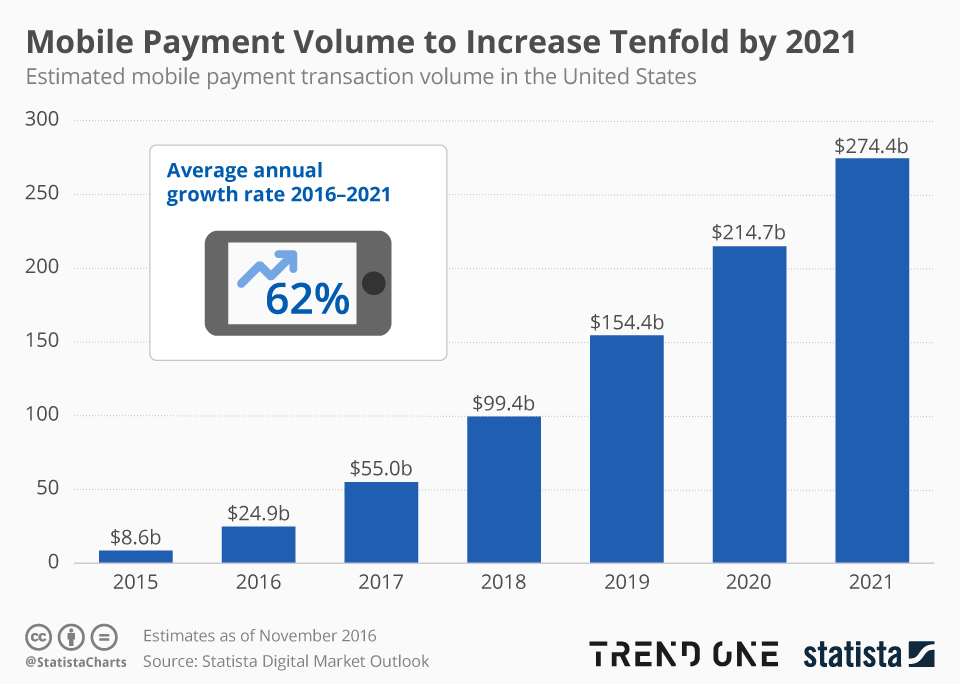

Mobile Payments

Well, this is a recent trend. The cashless transactions are made on the go. The effect of the Pandemic has not only curbed manual transactions but also has given rise to mobile payment applications to grow further. The incredible security features and ease of access make the customers use such platforms to make instant payments. Also, the cashback offers discount coupons and much more, making it an attractive factor for customers to use such payment apps.

For example, the payments of utility bills, restaurant, café bills, and more can be made through such mobile applications. Also, such apps are accepted by the service stations and gas pumps as well. The Fintech companies tie up with such organizations and create delectable apps for the customers to use. There are many available now, and you can also find many shooting this season as well.

“Card issuers want to be ‘top of the mobile wallet.'”

David Shipper (Analyst, Aite)

Transformation of Payment Digitization

The demands of the customers are growing day by day. It is about the secured payment factors and the various features that a Fintech can offer to its customers. With this ever-growing demand, application developers and finance companies are constantly pressured to innovate many payment policies and easy transaction methods.

The solutions offered by Fintech today will strive to upgrade tomorrow. At the same time, they are also on the constant search to contemplate the revenue for their firm. It will never cease as the demands are increasing daily, with the number of applications being developed almost every month.

Timely Order Fulfilment

It is where the client relationship begins. As seen earlier, order fulfilment is not only in the supplier’s hands but also in the buyer’s. The timely payment for the supplies and prompt execution of the prices every time develop relationships. It is triggered through digitization. The transparency it offers and the security of payment play a significant factor in the industry. The companies opt for such a digitized payment approach as it clears the bill instantly. Also, the B2B industry is all about acknowledging the services offered by the supplier. As a buyer, payment and timely acknowledgement are two significant factors in this regard.

Marketing Solutions

The expenditure in marketing campaigns and the operational expenses need thorough analysis. It will help any organization to fix a budget for their marketing solutions. Manual tracking of financial data and analyzing the same will take a lot of time and effort. At the same time, the accuracy with which one can arrive at a decision is also questionable.

“Effective spending in marketing and sales, however, means not pulling out the old playbook, but rethinking how to better use tools and capabilities to connect with customers.” — McKinsey

As the B2B firms start using digitized platforms, it helps in the speedy process of transactions. It helps generate reports that shall help you make decisions concerning expenditures in the future. You can also make investment plans based on the same. These days’ accounting solutions come with AI-based support, which shall also suggest to you the most recent trend in business investments. Moreover, streamlining the marketing processes is also possible with the cash flow. A more sustainable move by the organization is to incline towards digitization in terms of finance.

Flexible Payment Methods

“Offering flexible payment terms can lift sales by 17% and increase average order size by 21%.”

-Forrester Survey

We are aware of internet banking, debit card, and credit card transactions online. With the advent of robust B2B accounting solutions, you can use many types of payment methods. With cryptocurrency on the verge of hitting the market with sustainable payment models, you can utilize the same. Moreover, the payment applications have their wallet, and it gets filled with cashback and coupons as you make payments. You can use such services to make payments too. It does not cut down on your costs drastically but helps you save petty cash as you use it regularly.

Reminders and Actions Automation

It is the best part of the payment digitization process. As an organization, you might have many vendors working for you with different timelines of payments. Manual tracking is a daunting task. Also, maintaining records, receiving invoices, acknowledging them, and making payments on time look like a specific task.

As automation is on-trend, all these tasks are automated and can be done without any manual intervention. It not only makes the payment on time, but it also keeps track of the amount available in your bank account to trigger any dearth situations. The complete automation of the finance process is a boon to the industries from now on.

Social Network Development

With the use of automation, there is a considerable possibility to develop a network through the same. As you are a type of company, there might be many on the same ground. At the same time, you can be a buyer to a few organizations and a few. As you start getting into the digitized world of financial accounting, there is a trend developing in connecting organizations through social media. Also, the marketing campaigns run by the ERP solutions will fetch and gather data from other companies of similar thought. One can manage the expenditure, and one can curb the unwanted expenses.

Supply Chain Financing is On

The data that you capture through the accounting solutions is all the more enough to get more underwriting. The finance documents required to apply for a loan are available with a click. It is exceptionally advantageous with the banks opening up with more finance options to various industries.

Businesses do not stand any chance if the growing demands are not met. The primary requirement is the fast, secure, and reliable payment methods that the organizations are looking for. One must avoid the detrimental impact of slow payment methods with such solutions.