NetSuite SuiteBanking, a cutting-edge financial management solution, has significantly impacted the fintech sector. This comprehensive suite of tools is designed to empower businesses with the automation, insights, and control they need to thrive.

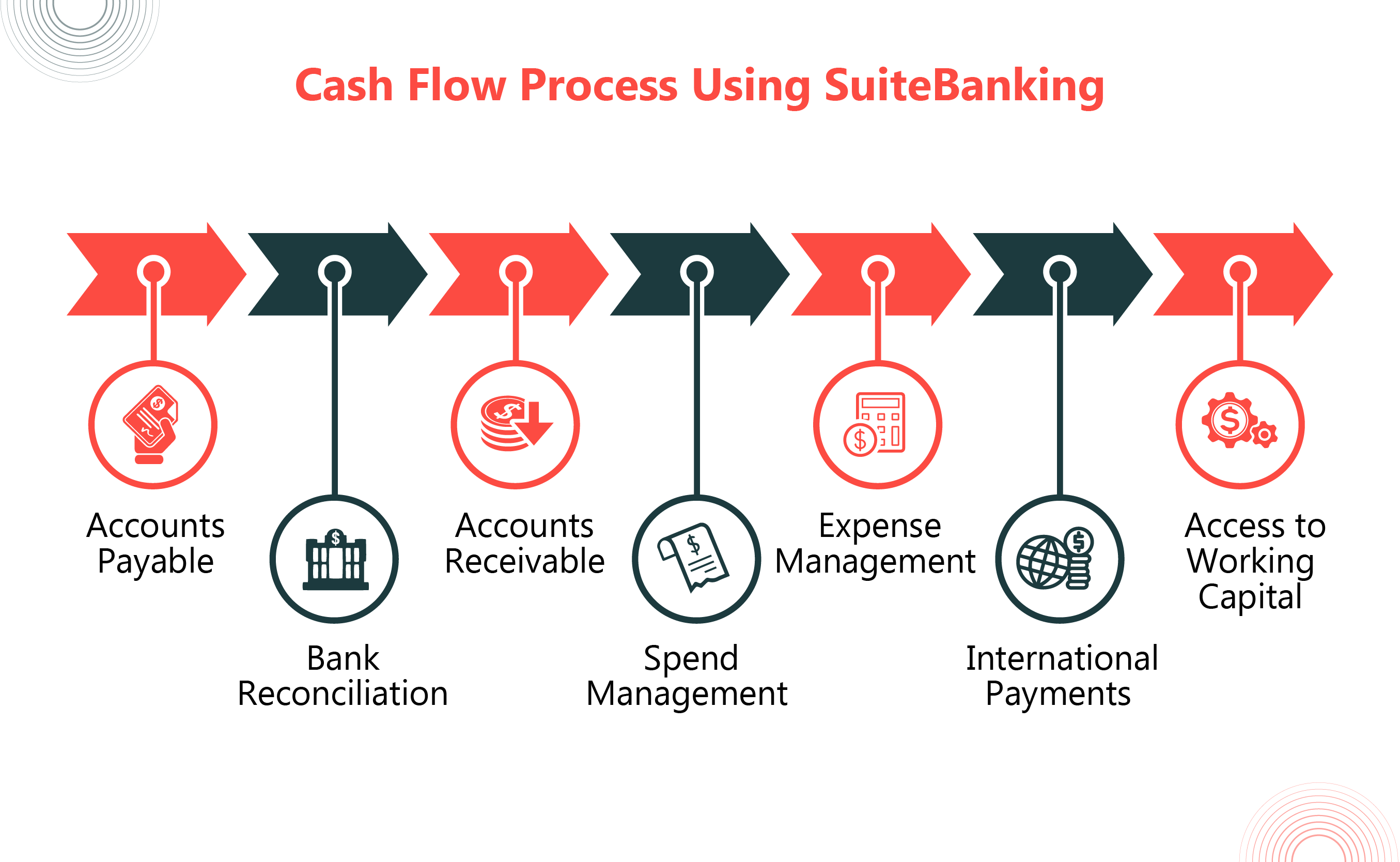

From streamlining accounts payable and receivable processes to simplifying bank reconciliation and optimizing spending and expense management, SuiteBanking offers a holistic approach to financial management. It doesn’t stop there; this also simplifies simplifies international payments and provides access to working capital.

What Is NetSuite SuiteBanking?

SuiteBanking is a comprehensive NetSuite financial solution. It’s designed to help businesses gain greater control over their cash flow and enhance financial management. SuiteBanking brings automation to accounts payable processes and handling account receivables, making tasks like bill payments and invoice handling more efficient.

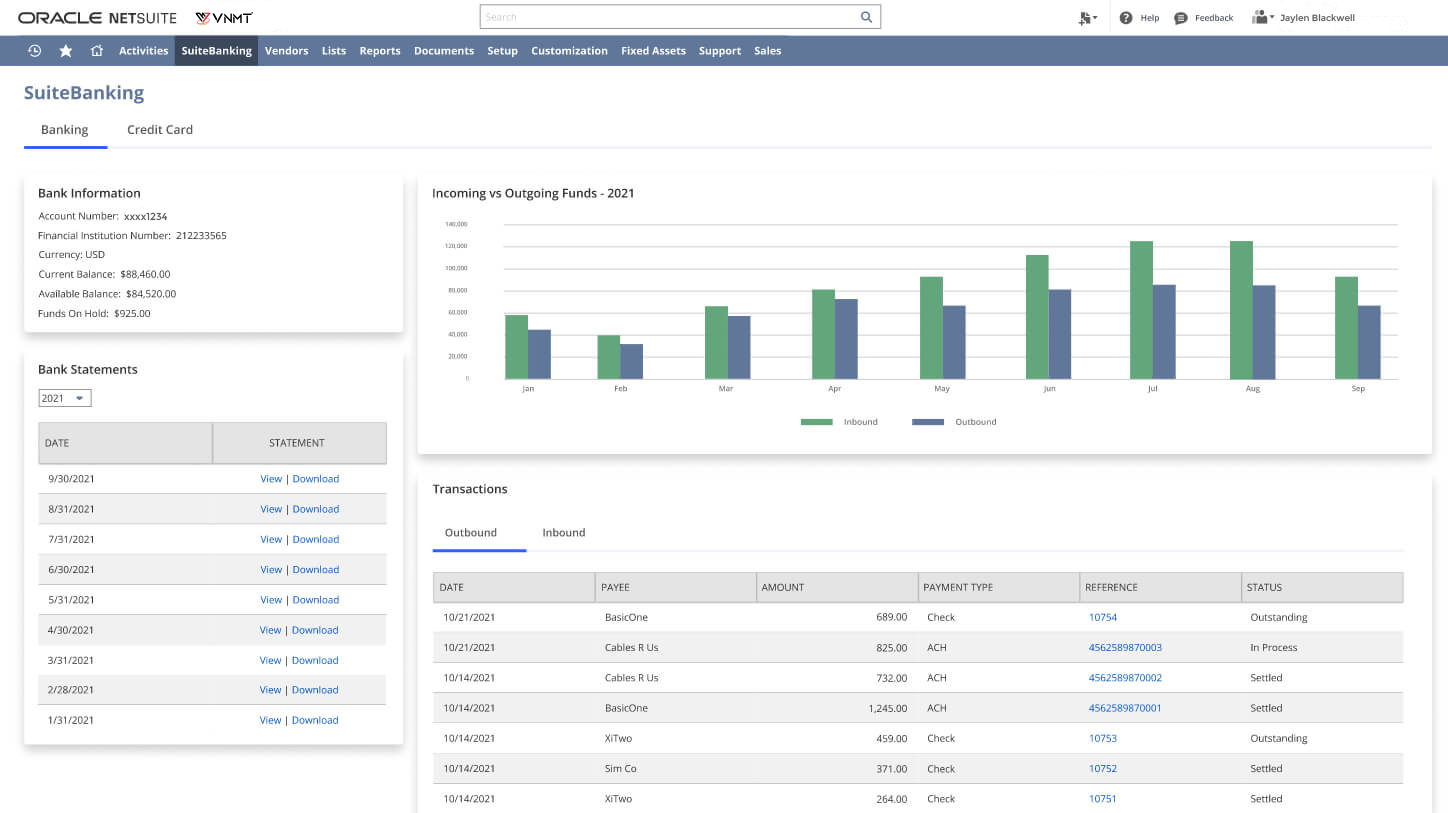

It also integrates with banking partners like HDFC, HSBC and more to provide access to payment card services and a global digital wallet, offering businesses more flexibility in making and receiving payments. By automating routine financial tasks and providing real-time financial insights, SuiteBanking enables organizations to reduce costs, minimize errors, and maintain healthy cash flow, ultimately empowering them to make more informed financial decisions and focus on strategic growth initiatives. Check Out how bank transactions, cash inflows, and outflows are displayed for each account daily.

Which Industry Should Use NetSuite SuiteBanking?

NetSuite SuiteBanking is a versatile financial management solution suitable for various industries. It is particularly beneficial for industries that require efficient cash flow management, streamlined financial processes, and real-time financial visibility. Some ideal industries for SuiteBanking include fintech, manufacturing, retail, e-commerce, professional services, healthcare, technology, and wholesale distribution.

These sectors often deal with complex financial transactions, vendor payments, and customer invoicing, making SuiteBanking’s integration and automation features highly valuable. Moreover, any organization seeking to enhance its financial efficiency, reduce costs, and gain better control over cash flow can benefit from implementing NetSuite SuiteBanking as part of its ERP and financial management strategy.

How can SuiteBanking automate Cash Flows?

NetSuite SuiteBanking offers a comprehensive suite of financial management tools and features to benefit businesses in accounting, reconciliation and more. Like companies prefer cloud accounting over traditional accounting for better finance management, organizations can leverage SuiteBanking to enhance their financial operations across different domains. Here is how it can optimize the cash flow procedures:

Accounts Payable

NetSuite SuiteBanking brings significant improvements to accounts payable processes in 2023. The automation capabilities offered by SuiteBanking play a pivotal role in accelerating these processes. Automated invoice scanning and general ledger code assignment reduce the manual workload, enabling finance teams to work more efficiently. Three-way invoice matching ensures accuracy in payments, minimizing discrepancies and errors that can often occur with manual processing.

A recent report by the American Productivity and Quality Center (APQC) found that the worst-performing companies spent nearly 75% more on vendor invoice processing than their peers, and the top performers spent almost a third. According to the APQC, automation is a major reason for the difference between leaders and laggards.

Source : NetSuite Article

One of the standout features is the automation of outbound payments. Also, streamlining accounts payable processes with NetSuite SuiteBanking makes bill payments and invoice handling more efficient.

SuiteBanking simplifies the payment process, making it fast and accurate. Moreover, it provides businesses with multiple payment options. This flexibility allows companies to select the preferred payment method for each vendor, considering factors such as speed and cost. For instance, businesses can choose the fastest payment option for critical vendors and opt for cost-effective methods for others.

The result is improved cash flow management. Companies can better control their expenses and choose payment methods that align with their financial goals. This not only enhances financial control but also contributes to stronger vendor relationships. Timely payments can lead to favourable vendor terms and even early payment discounts, ultimately benefiting the bottom line.

Accounts Receivable

NetSuite SuiteBanking offers a comprehensive solution to improve cash flow and reduce Days Sales Outstanding (DSO) for the fintech sector. Multiple payment methods, including credit/debit cards and third-party payment providers like PayPal, are supported. This flexibility caters to diverse customer preferences, ensuring businesses can accommodate various payment options.

Automation plays a crucial role in NetSuite accounts receivable. The creation and scheduling of invoices can be automated, reducing manual work and the risk of errors. Additionally, SuiteBanking allows for automated payment reminders. These reminders encourage customers to pay on time, contributing to a reduction in DSO and a healthier cash flow for the financial technology sector.

By improving the efficiency of billing staff and facilitating on-time payments, SuiteBanking empowers businesses to manage their cash flow more effectively. This, in turn, enables companies to allocate capital efficiently and seize growth opportunities as they arise.

Bank Reconciliation

Bank reconciliation is often a labor-intensive and error-prone task. However, with NetSuite SuiteBanking in 2023, this process is revolutionized. SuiteBanking eliminates manual, time-consuming tasks and ensures that transactions accurately match the organization’s bank account.

One of the key advantages of SuiteBanking is the real-time visibility it provides into inbound and outbound payments. This visibility is instrumental in enhancing cash flow management. Businesses can monitor their cash position anytime, ensuring they know how much cash is available in their accounts.

Transaction matching and reconciliation frequency can be increased with SuiteBanking, contributing to improved accounting accuracy. More frequent reconciliation means that discrepancies and errors are identified and addressed promptly, reducing the risk of financial inaccuracies.

As a result, this NetSuite accounting software empowers businesses with a better understanding of their financial position. Having access to real-time data allows organizations to make informed decisions about their cash requirements and how to allocate resources most effectively.

Spend Management

Effective spend management is crucial for businesses looking to optimize their financial performance. NetSuite SuiteBanking in 2023 offers powerful tools and features to achieve just that.

Customizable approval workflows are a standout feature, allowing businesses to tailor processes to their organizational structure. This flexibility ensures that spending approvals align with company policies and procedures. Additionally, expense policy rules can be customized to flag expenses that require managerial review, ensuring compliance and cost control.

One of the notable advancements is budget validation capabilities. SuiteBanking automates the comparison of open purchase requests to available budgets. Before approval, the system alerts to potential budget overages, allowing for timely adjustments. Real-time budget versus actual reporting is another critical feature that empowers managers to control spending. By comparing actual expenses against budgets, businesses can ensure that financial resources are allocated efficiently and that overspending is avoided.

Ultimately, SuiteBanking contributes to more efficient and controlled spend management. This helps organizations to manage their budgets effectively, make data-driven decisions, and minimize financial waste.

Expense Management

Expense management is essential in the fintech sector, and SuiteBanking will continue to excel in this area in 2023. Using virtual payment cards, SuiteBanking simplifies vendor payments, extends payment terms, and improves cash flow.

Virtual payment cards enable businesses to pay vendors directly out of NetSuite. This is particularly beneficial for managing cash flow since it provides more flexibility in settling vendor invoices. Companies can optimize the use of their available cash by extending payment terms.

Expense capture and submission are streamlined with SuiteBanking. Expenses can be captured and submitted electronically, eliminating the need for manual data entry. These expenses automatically flow into the NetSuite system, reducing errors and eliminating double entries.

Furthermore, businesses receive cash-back rewards on all transactions made using the virtual card for payments. This financial incentive adds extra value to the expense management process.

SuiteBanking enhances expense management by making it more efficient, cost-effective, and rewarding for businesses.

International Payments

SuiteBanking’s international payment capabilities will be a valuable asset in 2023. Its global digital wallet simplifies cross-border payments, leveraging HSBC’s extensive global network. This feature eliminates the need for multiple foreign bank accounts and country-specific payment providers, reducing complexity and ensuring smoother international financial operations.

With SuiteBanking’s international payment functionality, businesses can make and receive international payments efficiently. This simplification of international financial transactions benefits businesses operating on a global scale. It streamlines the payment process and removes the complexities of managing multiple foreign bank accounts.

A seamless and efficient international payment solution is a competitive advantage in an increasingly interconnected global economy. SuiteBanking gives businesses the tools they need to navigate international financial transactions easily.

Access To Working Capital

Access to working capital is vital for businesses seeking financial stability and investing in growth opportunities. SuiteBanking continues to provide this access in 2023 through accounts receivable financing.

This feature lets businesses quickly convert unpaid invoices into cash, providing liquidity to support ongoing operations and strategic investments. Accessing working capital promptly is crucial, especially in dynamic and competitive markets.

SuiteBanking’s accounts receivable financing feature empowers businesses to manage their cash flow effectively, ensuring that they have the financial resources needed to meet their obligations and seize growth opportunities as they arise.

Conclusion

In 2023, NetSuite SuiteBanking remains a powerful financial management solution that offers many ways to optimize businesses across various industries. With automation, real-time visibility, and streamlined processes, SuiteBanking helps businesses improve cash flow, reduce errors, enhance financial control, and ultimately position themselves for sustained growth and success in a competitive business landscape. For the best assistance and tailored solutions, consider leveraging NetSuite Customization Services to maximize the benefits of NetSuite SuiteBanking for your unique business needs. In a world where efficient financial management is crucial, this implementation of NetSuite for the Finance sector continues to be a valuable asset for businesses looking to thrive.