Both accounts receivable and payable are essential components of a company’s financial flow. The improvement of business productivity would result from streamlining these operations, and NetSuite software is the best option for doing so.

This blog can help you to discover more about the subject.

A Brief About Account Payable and Receivable Functions

An organization’s account payable and receivable functions are crucial. NetSuite accounts receivable are the sums of money that customers are contractually obligated to pay for products provided or services received but have not yet done so. The majority of the time, firms send them to their customers as invoices. Accounts receivable must be delivered on time in order to maintain a steady stream of cash for business operations. It is among the organization’s most crucial resources.

It is the opposite for accounts payable. It is the sum of money that a company owes to its suppliers and is considered a current obligation of the company. The conditions imposed by the creditors must be adhered to by the business owners while making these payments.

Accounts payable and receivable processes may be made more efficient and less expensive for the company. The greatest accounting software for streamlining accounts payable and receivable procedures is NetSuite. It can aid in reducing mistakes, increasing efficiency, lowering expenses, and ensuring fast payment. NetSuite has great features for monitoring, billing, and recovery.

What Is NetSuite Automation?

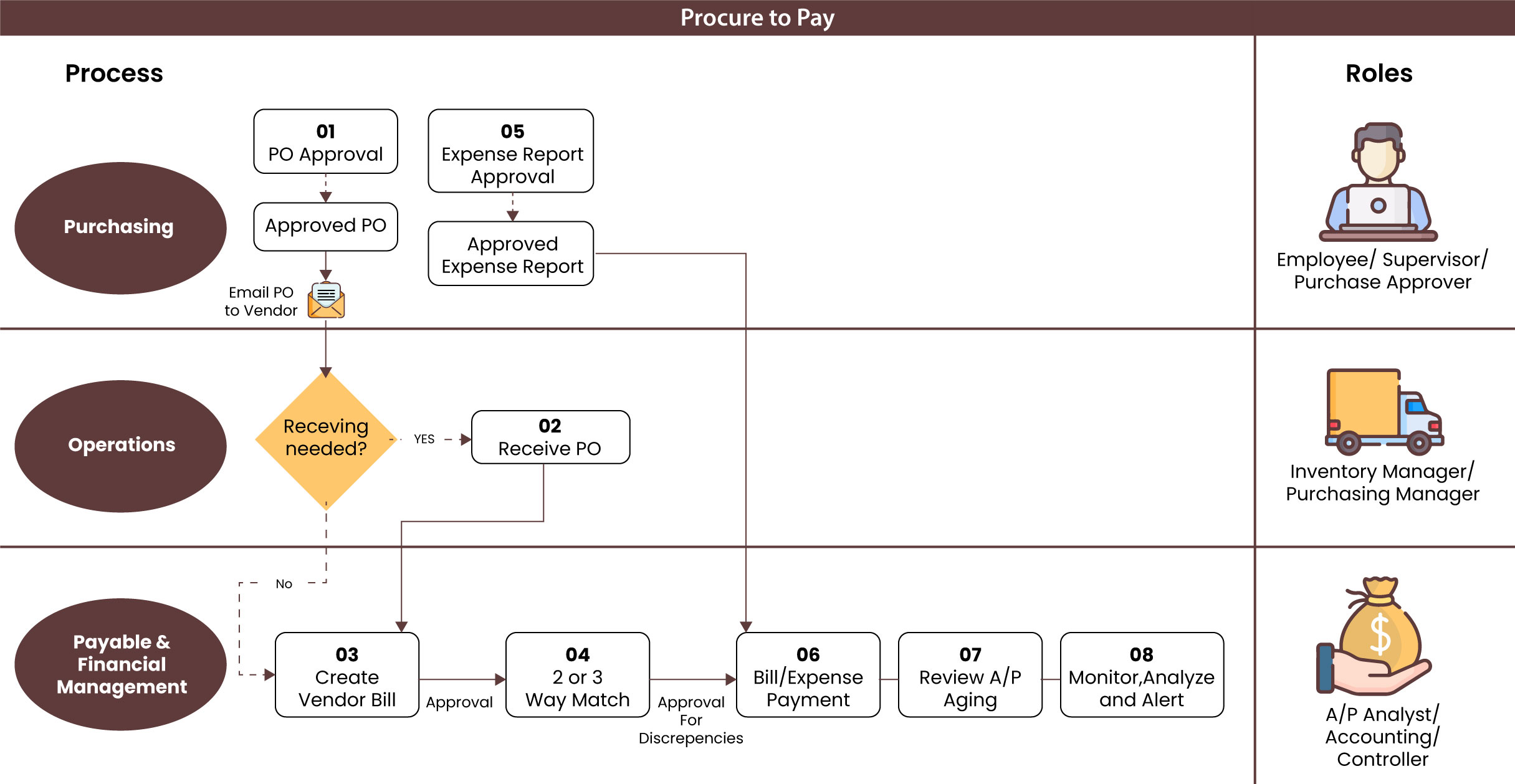

The automated evaluation, approval, and payment of vendor bills made possible by NetSuite AP automation increase an organization’s AP process efficiency. All facets of accounts payable are effectively managed using the NetSuite AP automation process, including:

- Management with Vendor List

- Make a payment

- Keep track of invoices and payables

An integrated approval workflow is also part of this effective and automated procedure, making the approval system more effective. With its wealth of functionality for payment administration, NetSuite is the best-automated invoice processing software and it streamlines the AP procedure. Further, it also enables error-free data reporting and increased productivity across all of an organization’s divisions.

What Is The Process & How Can NetSuite Help you With Account Payables and Receivables?

- You may build a number of reports using NetSuite accounts payable and accounts receivable depending on different criteria like date, category, department, etc. NetSuite makes it simple to get the data needed to complete the necessary tasks thanks to its sophisticated reporting functionality. Users have a lot of flexibility with the whole accounts payable process with standardized and personalized reports.

- Bills may be produced on the same day as the order is placed, which facilitates speedier payments.

- The only program that can adapt to the unique accounting regulations of various firms is NetSuite. The finest in terms of adaptability is NetSuite.

- Unlike other applications, which can only display NetSuite accounts payable reports that are no more than three months old, this program has the unique ability to display records from the earliest conceivable periods.

- The incredible cash collection potential makes it simple to bill consumers who have received things at different places.

- Online credit card or ACH payments can be handled quickly.

The above-mentioned points make it pretty clear how it helps commercial organizations understand the value of NetSuite accounts payable and receivable. However, the ultimate decision rests with senior management.

What Kind Of Strategic Opportunities Does NetSuite Bring In Your Grasp?

Notwithstanding this insight and the power that comes with it provided by the best AP automation software, there are still a number of ways to improve the efficiency of accounts payable processes and achieve strategic objectives. For instance, manually importing related invoices from CSV files or from a company’s growing list of vendors might take a lot of time. This rise in volume also increases the possibility of making expensive mistakes that will take much longer to correct later.

The identification and location of the paperwork needed for an audit can also be difficult and time-consuming for workplaces that are big or dispersed geographically. When specific bills are needed, a firm’s locations that import their own invoices and approve and pay them independently of the rest of the company may experience frenzied document searches. Every time an audit is underway, the reactive process of tracking down the necessary paperwork can consume a significant amount of staff time and significantly reduce team productivity.

Even with NetSuite’s extensive capability, the process of paying suppliers consumes more time than it should, which eventually prevents the AP team from concentrating on tasks that benefit the business. The capacity of a corporation to redeploy workers to carry out strategic assessments that can aid is hindered by doing manual operations that can be optimised.

Should You Really Automate Your NetSuite AP?

Any organisation may reduce time and resources spent on data input by integrating NetSuite payables into the procure-to-pay process. When less time and energy is invested in manually entering invoices and credit card information, corporate resources might well be redirected to other mission-critical duties, increasing productivity across the board.

Benefits Of NetSuite Accounts Payable

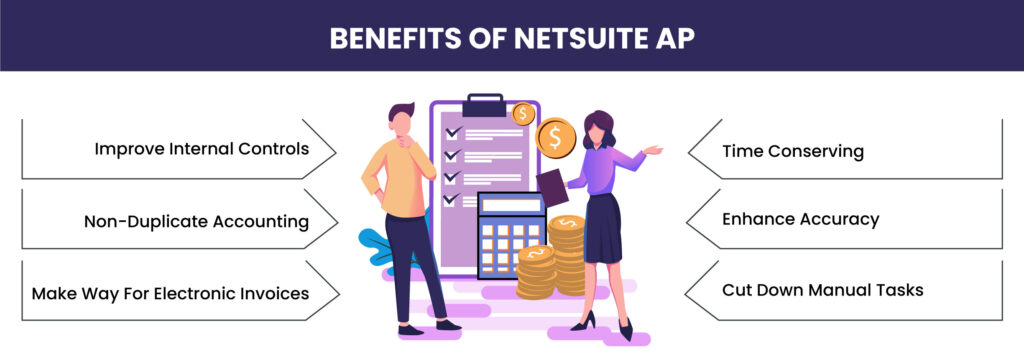

Well, NetSuite brings along a bunch of benefits for the user starting from saving significant time savings and efficient use of human resources to decreasing manual work for greater organizational effectiveness. Not just that, it also works wonders in improving internal controls, avoiding accounting duplications, and enhancing the ability to accept electronic invoices.

Let us dive deeper and understand these benefits with a closer look:

- Time Conserving

In a typical accounts payable system, bills are left unpaid although no due date is specified. This frequently damages interactions with suppliers and decreases the rate of the AP procedure. These delays may be avoided with automated routing, making the approval process much more efficient. When combined with PayTm’s spend management features, NetSuite AP automation is the perfect answer to the time crunch brought on by a swamped AP workflow since it offers automatic status reports, rule-based clearances, and a decrease in days payable outstanding (DPO).

- Enhance Accuracy

With just one optimised AP system, error minimization is assured. Fewer mistakes lead to better cost control as a result. Businesses may eliminate the manual entering of line-item data and associated invoice repetition.

- Cut Down Manual Tasks

NetSuite accounts payable automation helps businesses to access a larger portion of their human resources and devote them to other useful duties. Spend management improves accuracy and timekeeping by decreasing the amount of manual work that accountants and bookkeepers must perform on time-consuming and repetitive operations.

- Improve Internal Controls

Internal controls may be improved with the help of NetSuite AP automation. Stronger fraud detection, a decrease in payment mistakes, the reduction of human error, and improved uniformity are all made possible by NetSuite’s comprehensive and fully integrated AP automation.

- Non-Duplicate Accounting

Among the most frequent problems businesses have is receiving multiple payments for the same invoice. NetSuite AP management avoids redundancy in accounting processes with account match capabilities.

- Make Way For Electronic Invoices

Electronic invoicing enables bill submission and payment. This choice, made possible by NetSuite AP automation, boosts security across the whole AP process, increases efficiency, and decreases the margin for mistakes at the data entry point.

A company may obtain complete visibility and immediate access to accounts payable data with the help of NetSuite accounts payable automation, including data on invoices awaiting approval, check registers, AP ageing, and payments in progress. By implementing a single, simplified system, a business may gain from a more systematized and effective AP process.

Is NetSuite Effective In Helping With Taxes?

A corporation may save effort with tax payments by utilizing NetSuite AP automation in addition to the many advantages of employing NetSuite for more effective AP administration. Although it doesn’t have to be, the tax payment procedure can be labour-intensive. Adopting NetSuite AP management enables the automated entry and storage of tax records.

For goods defined as taxable, NetSuite will compute the applicable tax and include the values in the final amount charged to the client. The tax payment cost is determined using these equations, which streamlines the tax payments due for each transaction.

Are You Planning To Streamline The NetSuite Account Payable Workflow?

A business may handle payments more quickly and easily with NetSuite accounts receivable automation instead of putting in endless manual hours at the job. The mistakes that are a part of the AP process are eliminated by an automated approach. A business may boost productivity throughout the board by reducing the time and effort required and improving the Accounts Payable procedure.

Furthermore, all divisions within a business will use the same accounts payable procedures when AP workflows are standardized. Businesses are better prepared to address frequent problems like purchase order exclusions and receipt-invoice mismatches with a more systematic and systemized AP strategy, made possible by NetSuite connections.

How Can VNMT Help Your Business?

With a quick, efficient, and more secure approach to processing invoices and making payments, VNMT offers the best AP automation for NetSuite assistance to NetSuite users. A paperless procedure with adjustable 2-way and 3-way PO matching that allows flexible approval workflows and improved internal safeguards is included in our NetSuite package. Along with integrating payment management systems within NetSuite, VNMT for NetSuite also links to the network to offer safe payments and services in the best way.

- Elimination Of Paper Trail

With electronic vendor invoices, Eliminate Paper AP automation for NetSuite puts an end to never-ending mountains of paper, conserving your time & expense.

- Send Secure, Quick Payments

Due to increased security and visibility at all times, computerized invoicing and payments allow vendors to be paid more quickly and with less risk.

- Taking Up The Charge

You can gain more control over your operations, including assigning permissions and implementing your business standards, from the purchase agreement through the invoice to the payment.

Wrapping Up!

An organization that values time, productivity, and cost management would be prudent to integrate VNMT-handled NetSuite AP automation. Complete NetSuite AP automation provided by VNMT speeds up the AP procedure and improves visibility while processing vendor payments. VNMT also eliminates the need to enter any credit card numbers for diverse sellers. Additionally, with multi-currency functionality, international enterprises are completely supported.

Important Links: